On Tuesday, the Board of County Commissioners moved to increase impact fees for the first time since 2017. It’s seemingly gotten a lot of fanfare from the paid PR machines. But, before we all start throwing victory parades, printing those campaign mailers and planning all those new roads we’ll be building, let’s step back and see what we really did…and did not do.

Year after year, election after election, one of the main topics of conversation and concern is our Manatee County impact fees. If you’re stuck in traffic, if you’re begging for a new park, if you’re concerned about our public safety funding, if you’re waiting for that cramped library expansion, you can look to our underfunded, under collected impact fees for the reason why.

What are impact fees? Per Manatee County:

Impact fees are a one-time charge collected when new construction is completed in the unincorporated area of Manatee County. New construction increases demand for County infrastructure capacity, so impact fees ensure that new development pays its fair share of the capital cost incurred by the County to maintain adopted Levels of Service to accommodate population and job growth. (Don’t laugh…)

The use of impact fees is restricted to funding growth-related capital improvements for multimodal transportation, parks and natural resources, law enforcement, public safety, libraries and may not be used for replacing infrastructure, maintenance, or operations.

Seems simple enough. Every five years, we’re supposed to conduct a thorough study to determine the anticipated costs the community will incur to cover the additional infrastructure and burdens to our systems that the new growth will create. Those costs are to be borne by that growth as they are the cause of the strain. It’s a simple cost of doing business in a capitalistic, free market, conservative society.

However, that’s not what’s happening in Manatee County. We are certainly seeing the strains on our infrastructure and systems but we’re not seeing them rectified by the growth that’s causing them. For years, that cost has been heavily subsidized by the existing taxpayers…either through additional taxes or through living with substandard infrastructure.

Our last impact fee study was conducted in 2015 (eight years ago) based on data from 2014 (nine years ago). The calculated costs of growth would be substantially outdated at this point even in normal times. But the high-inflationary period we’ve gone through these past few years has further exacerbated this problem and this massive shortfall.

What’s worse, these outdated fees aren’t even being collected in full. They were increased to 90% of the cost of growth in April 2017 and they were never increased again. We’re presently not collecting the full cost of growth - in 2014 dollars - in 2023.

A full schedule of current Manatee County fees are here: IMPACT FEE SCHEDULE

Why are we under-collecting these critically important impact fees? Well, the very people that are creating the need are the ones that would need to pay for them. And they strongly prefer to hold onto their dollars when yours are readily available. But that undermines the very idea behind these fees when they were created.

Impact fees are essentially a Pigouvian tax. This is a tax that is set by the government to correct an undesirable or inefficient market failure. It is done by being set equal to the marginal costs of the negative effects to avoid them being borne by unrelated third parties. This is the type of fee or tax you see with pollution and, yes, uncontrolled growth.

Are there alternatives? Sure. Governments could limit growth through moratoriums to ensure future growth aligns with the infrastructure we can realistically provide with our own funds. We could also create a “cap and trade” type market to essentially auction off rights to develop in limited quantities and use those funds for growth. Finally, we could keep paying for all this unrestricted growth with alternative funds - namely, general tax funds.

None of these alternatives are palatable to one side or the other. Hence the need for, and justification of, impact fees.

We’re about to get into the numbers but, before I do, let’s get some things straight. Impact fees are not being “passed on to end buyers.” And if they do drive developers out, well, that’s how the free market is supposed to work. I thought this board said they were free market libertarians?

Impact fees are a cost of doing business. If materials go up, we don’t institute price controls. We don’t go to PGT and insist they keep the price of windows flat for nine years. If labor goes up, we don’t force workers onto the site. Why are the current residents the only part of the budget expected to artificially lower our costs to help make a home profitable?

Costs aren’t passed on - the free market and competitive housing options dictate price, not the cost of development. If development costs get too high, the developers will stop building. With the lower supply, home prices will go up. Once home prices are high enough again, sales will cover actual costs and builders will start building again. That’s literally how the free market works.

We’re told home prices will go up dollar for dollar with increased fees. Really? When lumber costs went up 1,000% a couple of years ago, new home prices jumped coincidently due to a demand surge. However, lumber costs have come way, way down since then. Have home prices receded dollar for dollar due to this lower construction cost? No. Same price. Why? Because people are willing to pay these higher prices and homes aren’t sold as a flat percentage above cost. They’re sold at whatever price someone is willing to pay and home builders aren’t going to voluntarily lower those prices if costs go down and excess profits are available.

In reality, impact fees are actually accretive to the end home price; not because buyers have to cover the cost but due to the perceived increase in value to those buyer. Providing roads, sidewalks, parks, etc. improves the community. Developers will get higher prices with these amenities in place. I would argue proper roads, less traffic, better parks and amenities, would increase the sales prices even more than the full fees.

However, if they know you’re paying to put these amenities in place and creating the same increase in sale price, why would they chip in? They know the public will yell loud enough that the board will do the work, even if it’s the public stuck paying for it.

So, what exactly are you paying for? In April 2023, Benesch, our consultant which no one had a problem with until everyone simultaneously had a problem with, presented an updated report. This report (FOUND HERE) laid out their expert analysis of the cost of growth going forward in Manatee County. (I say “expert” in that Benesch has done many Florida County impact fee studies as well as other government fee studies, including the new Sarasota School District, and I can’t find a single instance where someone successfully disproved their “methodology.”)

According to the Benesch study, Manatee County is only collecting an average of 40 cents for every dollar of the actual cost of growth.

For example, the study shows we’re collecting $6,415 in fees for a 1,700 sf single family home and it’s causing $17,151 in growth costs. We’re collecting $3,735 for a 1,300 sf apartment and it’s causing $8,368 in costs. We’re collecting $9,063 per 1,000 sf of commercial space and it’s causing $17,979 in cost.

Today, your tax dollars are subsidizing each 1,700 sf market rate house by $10,700; each apartment by $4,600 - yet we shut down gap financing for workforce housing with similar or lesser subsidies because that was “communism”...apparently.

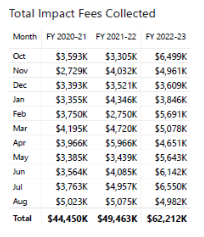

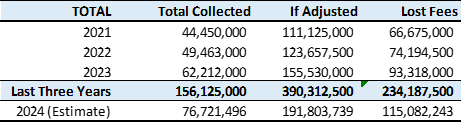

Manatee County has collected $156MM in impact fees over the past three years. That’s great but, more importantly, what haven’t we collected over this period based on the fee study…

If our impact fees had been set at the level calculated by the new study these last three years, when our last study essentially expired, we would have collected $390MM. That means we’ve forgone $234MM of fees that could have been used for roads, sidewalks, parks and other community needs. This includes the loss of $15MM in law enforcement fees that could have built a fleet facility; $8.4MM in public safety fees for EMS stations; and $33MM in park impact fees for anyone waiting on baseball clovers and soccer fields in north county.

Look at the bottom row of the above table. Impact fee collections have increased at an average annual rate of 23.3% these past few years due to the growth in permits. That implies an estimated collection of $76.7MM in FY 2024. It also implies lost collections of an additional $115MM based on the study in-hand that we were supposed to vote on.

That’s bringing our total four year uncollected fees up to around $350MM. This is surprisingly close to the approximately $400MM in general revenue fund bonding we’ve taken on these past two years for infrastructure. Essentially, we’ve offset these lost impact fees that would be paid by future growth with funds which will be paid, with interest, by current residents in order to provide needed infrastructure. Because, really, those are our only options. We claim to be the “infrastructure board.” So, we can’t simply not build anything, so we build these roads with whatever money we can find. A majority of it is coming from you until we adjust this schedule.

Whether you like it or not, you are paying for a majority of someone else’s growth and you’ll be paying that off for decades.

We need to fix this or we will eventually run out of sources of funds. The longer we wait, the worse it will get. Why? In large part it’s due to the Impact Fee Credits. These are a state required system that allows developers to provide infrastructure (usually conveniently benefiting their own property) and they get to take impact fee offsets against their cost of construction. HOWEVER, we are required by statute to give them credit dollar-for-dollar on their costs (in 2023/24 dollars) by offsetting the impact fees they’re supposed to pay the county for growth (in 2014 dollars).

There is such a huge difference in costs today, that many subdivisions and projects are putting in their own infrastructure, almost entirely for their own use, and not only offsetting 100% of their total project impact fees, but actually getting a sizable refund check from the County for their troubles! We not only lose ALL impact fees for use in higher-need areas that have been patiently waiting their turn, but we have to dig into your pocket, or into other impact fees, to pay them the difference. Every year, this gets worse and worse as the gap widens more and more. This is unsustainable.

Now we finally get to the real crux of the issue regarding Tuesday. We had a study prepared. We voted on April 18 to bring it forward to finalize and set new, sustainable impact fees. We opened up public comment in June for 30 days and closed it in July. It was supposed to go to the Planning Commission and then the BOCC in August. This should have been voted on and already in effect by today. Instead, we’re manufacturing reasons to delay this much further. Why? People are now concerned about the report and the consultant.

They weren’t concerned when we, and many other counties, used this consultant in the past. Staff seemed happy with the report in April. They were happy with it during public comment. They were happy enough with it each month they pushed the hearing rather than approaching the board with these new concerns. What changed?

Well, the “30-day public comment window” only applies to most people. Select others seemingly had open-ended opportunities to comment and lay out arguments to convince people to be concerned. We’re told this delay will cost the taxpayers $250,000 for a new study. Nope. It will potentially cost the taxpayers $115MM in lost fees that you’ll be paying for one way or another.

It’s not the study that’s costly, it’s the delay in continuing to use massively outdated fees while having to find ways for this “infrastructure board” to make good on one promise publicly, while seemingly making good on another promise privately.

So, the motion was made to “increase” impact fees from 90% to 100% while a new study is conducted. This motion is to finally charge the actual, full 2014 cost of growth…in 2024. This will result in approximately $8.5MM more in fees for FY 2024 (admittedly better than nothing…it’s one whole lane mile). Of course, if I adjust those 2014 costs up-to-date based simply on annual inflation rates, they would be 39.4% higher even without a study telling me how much more they should be. Just an inflationary adjustment would result in $30.2MM more in fees. If we approved the study we’ve been sitting on all year, it would result in $115MM more in fees.

This motion was better than doing nothing but it’s not better than doing something.

This is a distraction by offering up pennies while the current residents need dollars. It’s the proverbial “be thankful you’re getting anything at all” mentality.

We need to insist that the current, vetted Manatee County Impact Fee Study be voted on and finalized immediately. If the Board wishes to conduct another study, they can do so after our fee schedule is adjusted to properly collect the real cost of growth while we wait. I believe some on the Board want to do the right thing. Give them the support and encouragement to move this forward.

This delay is going to cost all taxpayers substantially more than anticipated both in real dollars and in inferior infrastructure. It’s unnecessary, and timed to push this report out past election cycles. You’ll hear plenty of campaign trail talk about “raising impact fees”, “making developers pay their fair share” and “holding developers accountable.”

Just remember, everyone on this Board has an opportunity right now to act on these statements and actually prove their sincerity. But, I guess $115MM is a small price to pay for some great sound bites in 2024.

Nicole Knapp was Impact Fee Coordinator at the time this was presented in April 9, 2023 (and that was at 90%). She seemed fine with it then. De Pol got to her and then made her director of Development Services. Unfortunately, a new study is needed because it has been 8 years (statutes say 5) but in the meantime lets collect more. I remember when development did pay 100% but when the bubble burst around 2007-08 everything went to hell. Hasn't been equitable since construction picked up again.

Excellent analysis. In a state with no income tax, most of our needs are funded with property taxes. Not only is an increase in impact fees capped, but the increase in property taxes from a vacant lot to a completed home are subject to a non homestead cap of 10%. This should be removed once a property has been improved more than 25% but that never happens. The only one paying the fair market value assessment is the home buyer, no matter how long the completed home sits on the market. It should be fairly easy to figure out which homes should have the cap removed by searching for certificate of occupancy. The money is there but it’s a lot easier to take it from the little guy than developers and their teams of lobbyists and lawyers.